Investments

We measure success by the strength of our relationships.

Venture & Emerging Growth

We look to partner with exceptional founders and management teams that are meaningfully changing their industries and looking for engaged, long-term capital partners.

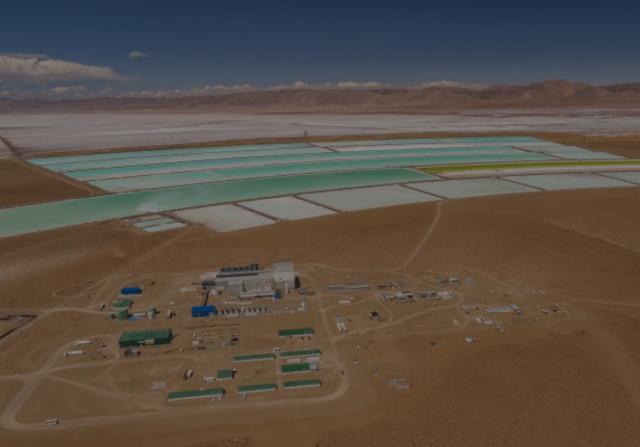

Mature Middle-Market Companies

We target market-leading (middle-market) companies with $10M-$50M of EBITDA. Our typical initial equity investment is $25M–$100M, with the ability to invest more over time.